Is Also Called Terminal Value or Continuing Value

What is the Terminal Value?

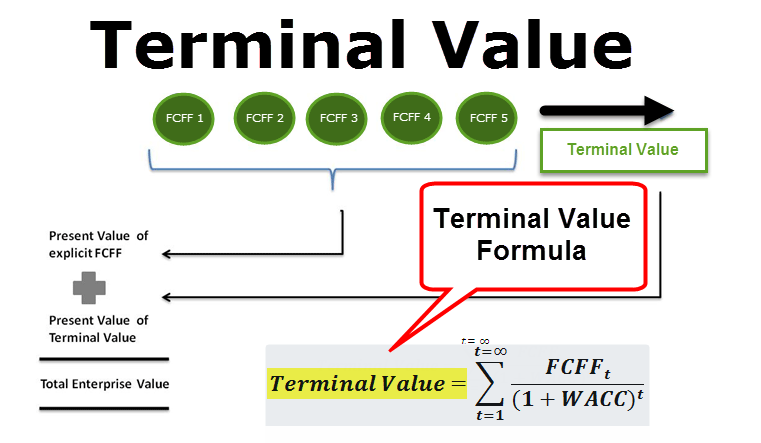

Terminal Value is the value of a business or a project beyond the explicit forecast period wherein its present value cannot be calculated. It includes the value of all cash flows, regardless of duration, and is an important component of the discounted cash flow model (DCF).

In DCF, the terminal value is the value of a company's expected free cash flow beyond the period of an explicit projected financial model.

You are free to use this image on your website, templates, etc, Please provide us with an attribution link Article Link to be Hyperlinked

For eg:

Source: Terminal Value (wallstreetmojo.com)

Table of contents

- What is the Terminal Value?

- Understanding Terminal Value

- Terminal Value Calculations

- #1 – Perpetuity Growth Model

- #2 – No Growth Perpetuity Model

- #3 – Exit Multiple Method

- Terminal Value Calculation Example in Excel

- Alibaba Terminal Value

- Can You Get Negative Terminal Value?

- Limitations of Terminal Value

- Terminal Value Video

- Conclusion

- What's Next?

- Recommended Articles

Understanding Terminal Value

Useful Downloads – 1) Free Terminal Value Excel Templates (used in the post) and 2) Alibaba IPO TV Calculation Model

You can download this Terminal Value Calculation - Excel Templates here – Terminal Value Calculation - Excel Templates

Terminal value is a key requirement of the Discounted Cash Flow.

- It isn't easy to project the company's financial statements showing how they would develop over a longer period.

- The confidence level of financial statement projection diminishes exponentially for years, which is way farther from today.

- Also, macroeconomic Macroeconomics aims at studying aspects and phenomena important to the national economy and world economy at large like GDP, inflation, fiscal policies, monetary policies, unemployment rates. read more conditions affecting the business and the country may change structurally.

- Therefore, we simplify and use certain average assumptions to find the firm's value beyond the forecast period (called "Terminal Value") as provided by Financial Modeling Financial modeling refers to the use of excel-based models to reflect a company's projected financial performance. Such models represent the financial situation by taking into account risks and future assumptions, which are critical for making significant decisions in the future, such as raising capital or valuing a business, and interpreting their impact. read more .

The following graph shows why we calculate Terminal Value in DCF.

You are free to use this image on your website, templates, etc, Please provide us with an attribution link Article Link to be Hyperlinked

For eg:

Source: Terminal Value (wallstreetmojo.com)

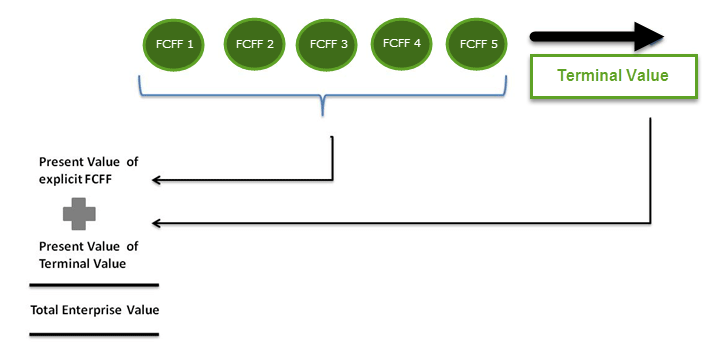

Terminal Value Calculations

There are three ways to calculate the Terminal Value of the Firm. The first two approaches assume that the company will exist on a going concern Any analyst analyzing a company will be left to a basic assumption that the company does not go bankrupt or file a chapter 11 bankruptcy. This basic assumption allows the analyst to think that there is no immediate danger to the company. The company can operate until infinity is called the principle of going concern. read more basis at the time of estimation of TV. The third approach assumes the company is taken over by a larger corporation, thereby paying the acquisition price. Let us look at these approaches in detail.

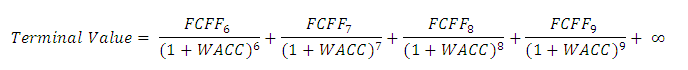

#1 – Perpetuity Growth Model

Please remember that the assumption here is that of "going concerned."

This method is the preferred formula to calculate the firm's firm's Terminal Value. This method assumes that the company's growth will continue (stable growth rate), and the return on capital will be more than the cost of capital. We discount the Free cash flow The cash flow to the firm or equity after paying off all debts and commitments is referred to as free cash flow (FCF). It measures how much cash a firm makes after deducting its needed working capital and capital expenditures (CAPEX). read more to the firm beyond the projected years and find the Terminal Value.

Using cool maths, we can simplify the formula as per below –

Terminal Value Calculation = FCFF6 / (WACC – Growth Rate)

Numerator of the above formula can also be written as FCFF (6) = FCFF (5) x (1+ growth rate)

The revised calculation of terminal value is as follows –

Terminal Value = FCFF5 * (1+ Growth Rate) / (WACC – Growth Rate)

A reasonable estimate of the stable growth rate here is the GDP growth rate of the country. Gordon Growth Method can be applied in mature companies, and the growth rate is relatively stable. An example could be mature companies in the automobile sector, the consumer goods Consumer goods are the products purchased by the buyers for consumption and not for resale. Also referred to as final products, examples of consumer goods include an Apple cellphone or a box of Oreo cookies. Consumer goods companies and the industry offer a vast range of products that heavily contribute to the global economy. read more sector, etc.

#2 – No Growth Perpetuity Model

This formula assumes that the growth rate is zero! This assumption implies that the return on new investments is equal to the cost of capital.

Non-growth perpetuity terminal value calculation.

Terminal Value = FCFF6 / WACC

This methodology may be useful in sectors where competition is high, and the opportunity to earn excess returns tends to move to zero.

#3 – Exit Multiple Method

This formula uses the underlying assumption that a market with multiple bases is a fair approach to value a Business. A value is typically determined as a multiple of EBIT or EBITDA EBITDA refers to earnings of the business before deducting interest expense, tax expense, depreciation and amortization expenses, and is used to see the actual business earnings and performance-based only from the core operations of the business, as well as to compare the business's performance with that of its competitors. read more . For cyclical businesses, instead of the EBITDA or EBIT amount at the end of year n, we use an average EBIT or EBITDA throughout a cycle. For example, if the metals and mining sector is trading at eight times the EV/EBITDA multiple EV to EBITDA is the ratio between enterprise value and earnings before interest, taxes, depreciation, and amortization that helps the investor in the valuation of the company at a very subtle level by allowing the investor to compare a specific company to the peer company in the industry as a whole, or other comparative industries. read more , then the company's TV implied using this method would be 8 x the EBITDA of the company.

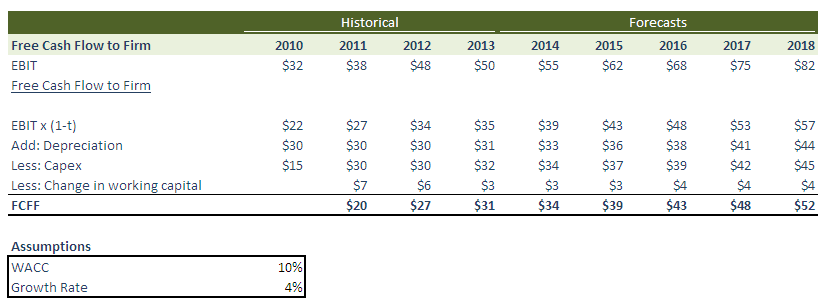

Terminal Value Calculation Example in Excel

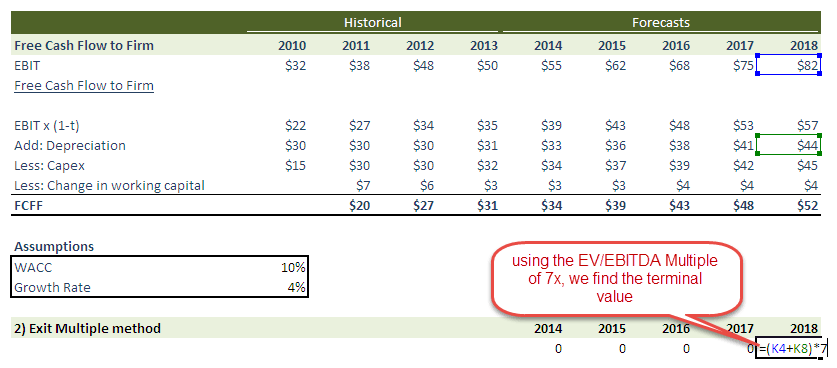

In this example, we calculate the fair value of the stock using the two-terminal value calculation approaches discussed above.

In addition to the above information, you have the following information –

- Debt = $100

- Cash = $50

- Number of shares = 100

Find the per share fair value of the stock using the two proposed terminal value calculation methods.

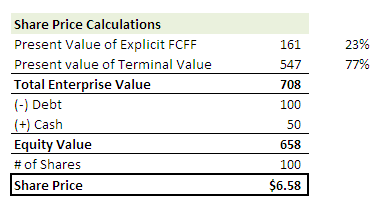

Share Price Calculation – using the Perpetuity Growth Method

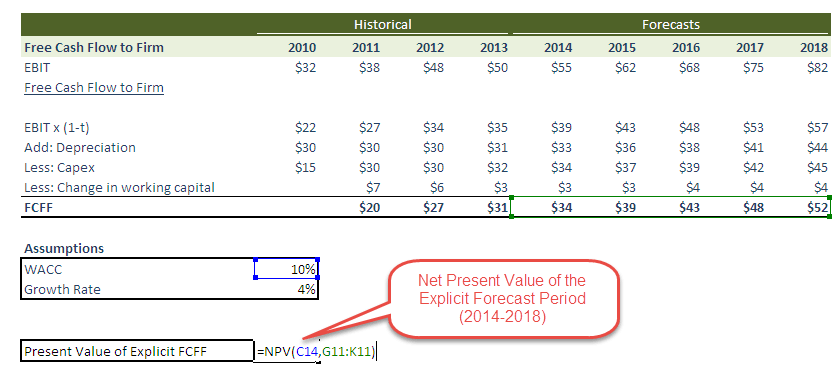

Step 1 – Calculate the NPV of the Free Cash Flow to the firm for the explicit forecast period (2014-2018)

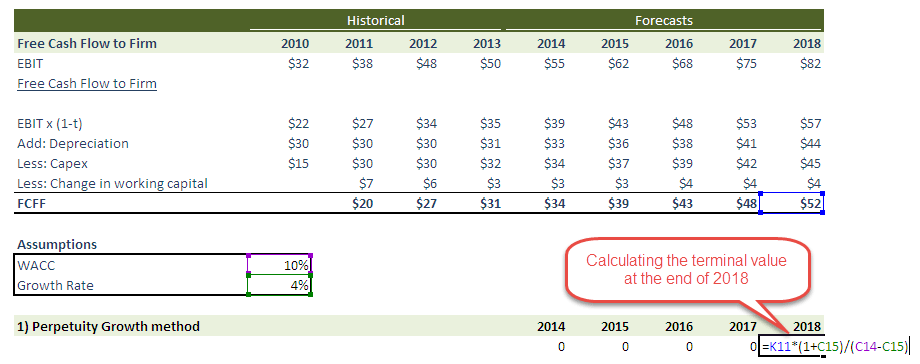

Step 2 – Calculate the Terminal Value of the Stock (at the end of 2018) using the Perpetuity Growth method.

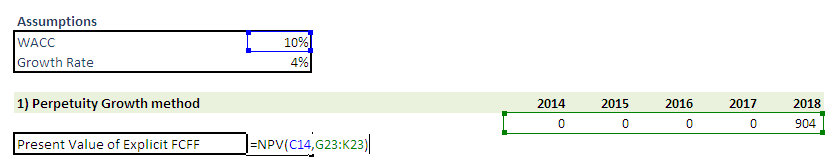

Step 3 – Calculate the Present Value of the TV

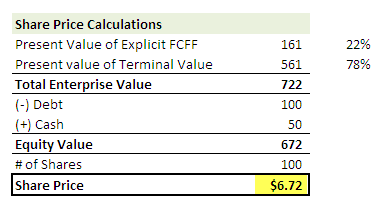

Step 4 – Calculate the Enterprise Value and the Share Price

Please note that the Terminal value contribution towards Enterprise value is 78% in this example! This is no exception. Generally, you will note that it contributes to 60-80% of the total value.

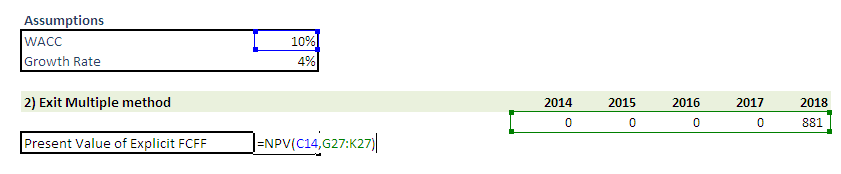

Share Price Calculation – using the Exit Multiple Method

Step 1 – Calculate the NPV of the Free Cash Flow to the firm for the explicit forecast period (2014-2018). Please refer to the above method, where we have already completed this step.

Step 2 – Calculate the Terminal Value of the Stock (at the end of 2018) using the Exit Multiple Method. Let us assume that the average companies are trading at a 7x EV/EBITDA multiple in this industry. Then, we can apply this very same multiple to find the TV in this stock.

Step 3 – Calculate the Present Value of the TV

Step 4 – Calculate the Enterprise Value and the Share Price

Please note that TV contribution towards Enterprise value is 77% in this example!

With both methods, we are getting share prices that are very close to each other. Sometimes, you may note large variations in the share prices, and in that case, you need to validate your assumptions to investigate such a large difference in share prices using the two methodologies.

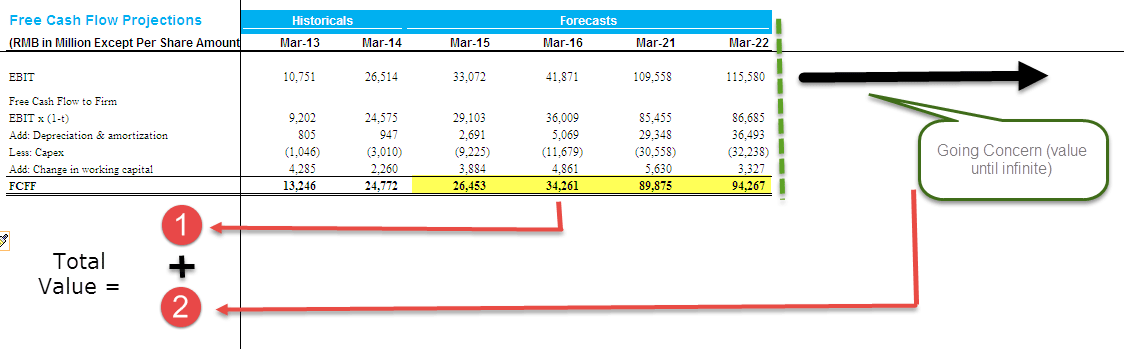

Alibaba Terminal Value

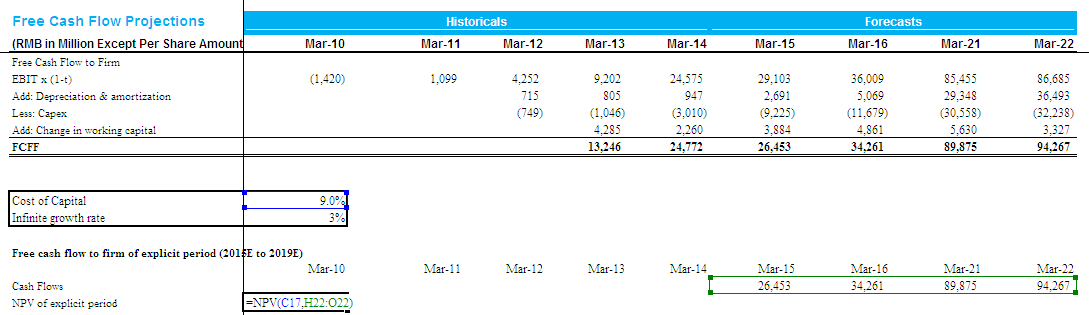

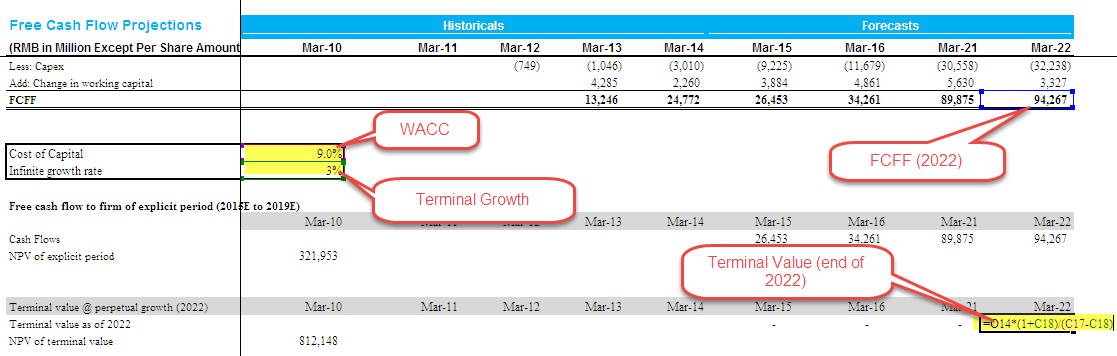

You may download Alibaba's Financial Model from here. The below diagram details the free cash flow of the firm of Alibaba and the approach to finding a fair valuation of the firm.

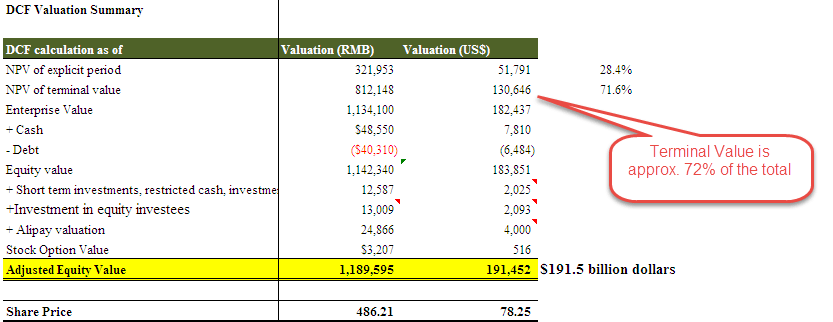

Valuation of Alibaba =Present Value of FCFF (2015-2022) + Present Value of FCFF (2023 until infinite "TV")

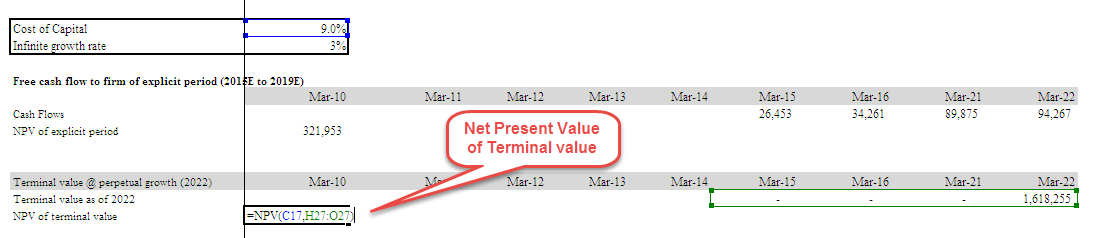

Step 1 – Calculate the NPV of the Free Cash flow to the firm Alibaba for the explicit period (2015-2022)

Step 2 – Calculate the Terminal value of Alibaba at the end of the year 2022 – In this DCF model, we have used the Perpetuity Growth method to calculate the Terminal Value of Alibaba.

Step 3. Calculate the Calculate the Net Present Value Net Present Value (NPV) estimates the profitability of a project and is the difference between the present value of cash inflows and the present value of cash outflows over the project's time period. If the difference is positive, the project is profitable; otherwise, it is not. read more of the TV.

Step 4 – Calculate the Enterprise Value and Fair Share Price of Alibaba

Please note that TV contributes approximately 72% of the total Enterprise Value in the case of Alibaba.

Can You Get Negative Terminal Value?

Theoretically, YES, Practically NO!

Theoretically, this can happen when the Terminal value is calculated using the perpetuity growth method.

Terminal Value = FCFF5 * (1+ Growth Rate) / (WACC – Growth Rate)

In the above calculation, if we assume WACC < growth rate, then the value derived from the formula will be Negative. This is very difficult to digest as a high-growth company is now showing a negative terminal value because of the formula used. However, this high growth rate assumption is incorrect. We cannot assume that a company will grow at a very high rate until it is infinite. If this is the case, this company will attract all the capital available in the world. Eventually, the company would become the entire economy, and everyone working for this company (Awesome! unfortunately, this is unlikely!)

When doing valuation, a negative terminal value practically doesn't exist. However, if the company is in huge losses and goes bankrupt in the future, the equity value will become zero. Another cause could be if the company's product is becoming obsolete, like the typewriters or pagers, or Blackberry(?). So you may also land up in a situation where equity value may become closer to zero.

Limitations of Terminal Value

- Please note that if we use the exit multiple methods, we are mixing the Discounted Cash Flow approach with the Relative Valuation Approach as the exit multiples have arrived from the comparable firms.

- It typically contributes more than 75% of the total value. This becomes a bit risky if you consider that this value varies a lot with even a 1% change in WACC or Growth Rates.

- Companies like Box The analysis of the Box IPO valuation can be done using various methodologies which are Relative Valuation – SaaS Comparable Comps, Comparable Acquisition Analysis, Using Stock-Based Rewards, Valuation cues from Private Equity Funding, Valuation cues from Dropbox Private Equity Funding, and Discounted Cash Flow Approach for Box IPO Valuation. read more can demonstrate negative Free Cash Flow to the firm. In this case, none of the three approaches will work. This implies that you cannot apply a Discounted Cash Flow approach. The only way to value such a firm will be to use Relative valuation multiples.

- The growth rate cannot be greater than WACC. If such is the case, you cannot apply the Perpetuity Growth Method to calculate Terminal Value.

Terminal Value Video

Conclusion

Terminal Value is a very important concept in Discounted Cash Flows as it accounts for more than 60%-80% of the firm's total valuation. You should pay special attention to assuming the growth rates (g), discount rates (WACC), and the multiples (PE ratio The price to earnings (PE) ratio measures the relative value of the corporate stocks, i.e., whether it is undervalued or overvalued. It is calculated as the proportion of the current price per share to the earnings per share. read more , Price to Book Price to Book Value Ratio or P/B Ratio helps to identify stock opportunities in Financial companies, especially banks, and is used with other valuation tools like PE Ratio, PCF, EV/EBITDA. Price to Book Value Ratio = Price Per Share / Book Value Per Share read more , PEG Ratio The PEG ratio compares the P/E ratio of a company to its expected rate of growth. A PEG ratio of 1.0 or lower, on average, indicates that a stock is undervalued. A PEG ratio greater than 1.0 indicates that a stock is overvalued. read more , EV/EBITDA, or EV/EBIT). It is also helpful to calculate the terminal value using the two methods (perpetuity growth method and exit multiple methods) and validate the assumptions used.

What's Next?

If you learned something new or enjoyed the post, please comment below. Let me know what you think. Many thanks, and take care. Happy Learning!

Recommended Articles

- Enterprise Value Formula

- Gordon Growth Model Formula

- Equity Value Examples

- Example of FCFF

Source: https://www.wallstreetmojo.com/terminal-value/

0 Response to "Is Also Called Terminal Value or Continuing Value"

Post a Comment